how to reduce taxable income for high earners australia

Invest in municipal bonds. This is a tax-effective strategy because super contributions.

Pdf Does Australia Have A Good Income Tax System

With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be given from.

. Note also that if you only live there for two out of five years before selling that. Salary sacrifice is one method for learning how to save tax in Australia. Use charitable trusts and other deductions.

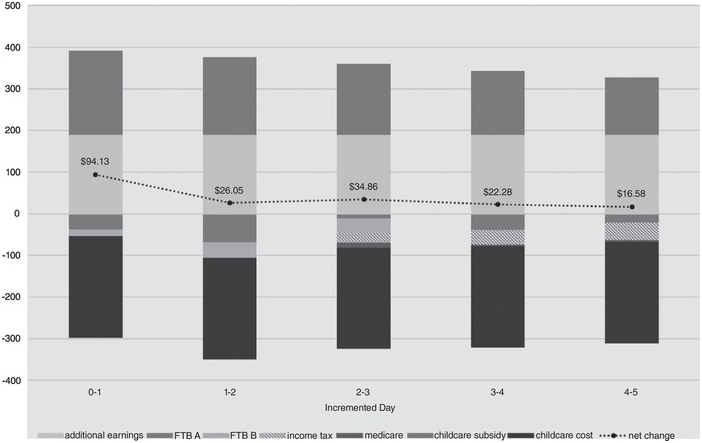

Jane earns 230000 salary per year and has 2 adult children of 19 and 18. This is known as salary packing and it operates in a variety of ways. Create a Sound Wealth Transfer Plan.

How do high-income earners reduce taxes in Australia. How To Reduce Taxable Income For High Earners 2020. Set up a discretionary trust.

Change the way you get paid. You can apply if your pension income is taxable. Note that any depreciation taken while it was a rental property would still have to be recaptured.

Both are studying and will continue education for another 5. See our top 7 tips to lower the amount of tax you pay from the Valles accounting team. How to reduce tax for high income.

An easy way to avoid paying this for high-income earners is by acquiring private health insurance hospital cover making it an easy way to reduce tax. Invest in Companies that Pay Dividends. High-value assets are heavily taxed.

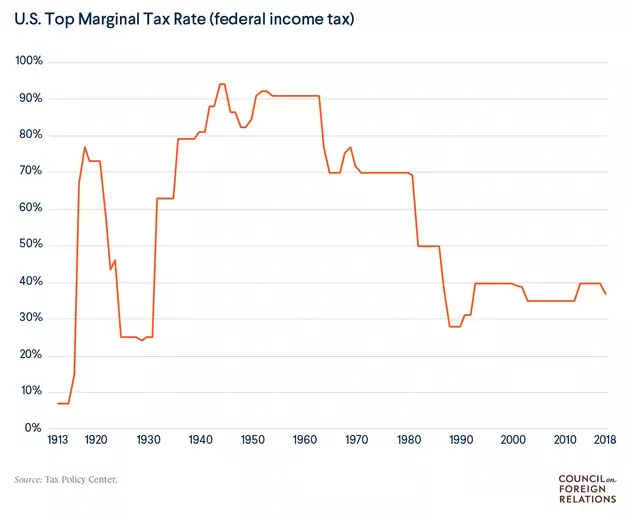

If youre a high-income earner in Australia it is wise to implement a tax minimization strategy. 10 Tax Reforms for Growth and Opportunity. Thus understanding how to reduce taxes for high income earners can be used to benefit your financial situation.

The more you earn the more invested youre likely to be in making sure that. Using a Discretionary Trust to reduce taxes. Set up a Donor-Advised Fund.

Maximizing all of your. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win.

The income that you earn from your job is taxed at ordinary income rates and the result is that you pay a high tax rate if you are a high. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. Operate salary sacrifice.

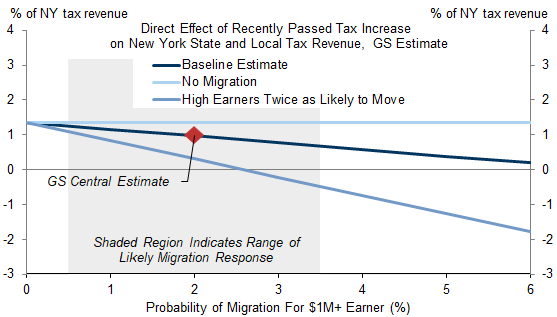

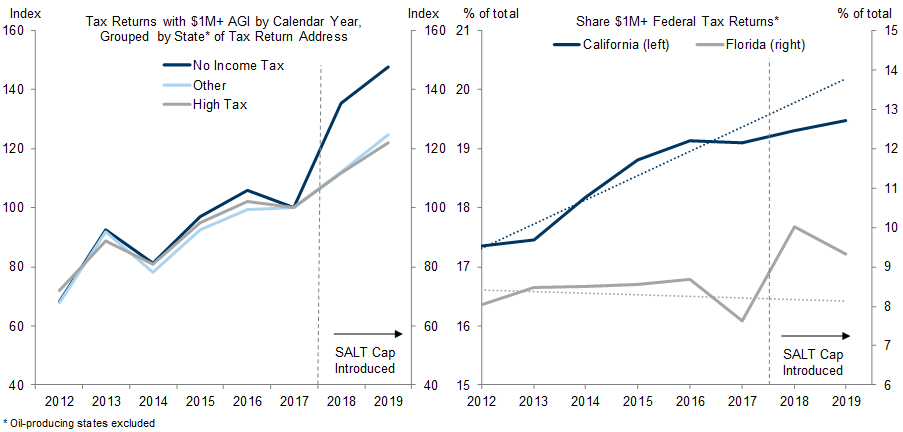

Annual taxable income. How do high-income earners minimise what they owe to the ATO. Overall the out-of-state moves and tax avoidance.

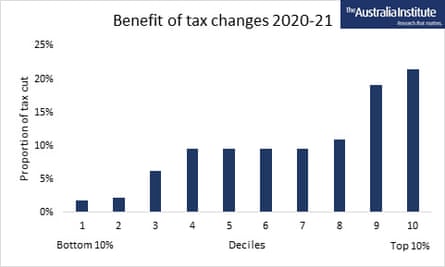

High Income Earners To Reap 88 Of Coalition S Tax Cuts By 2021 22 Australian Economy The Guardian

Tax Reduction Strategies For High Income Earners 2022

Average American Remains Ok With Higher Taxes On Rich

A Bit Rich A Government Plan To Make Tax Less Progressive The Government S Tax Plan Will Make Income Tax Policy Commons

No Taxation Without Emigration Briggs

Tax Law In Context Part Ii Tax And Government In The 21st Century

High Earners Reap The Rewards As Kwarteng Ditches Redistribution Financial Times

How To Pay Less Taxes For High Income Earners Wealth Safe

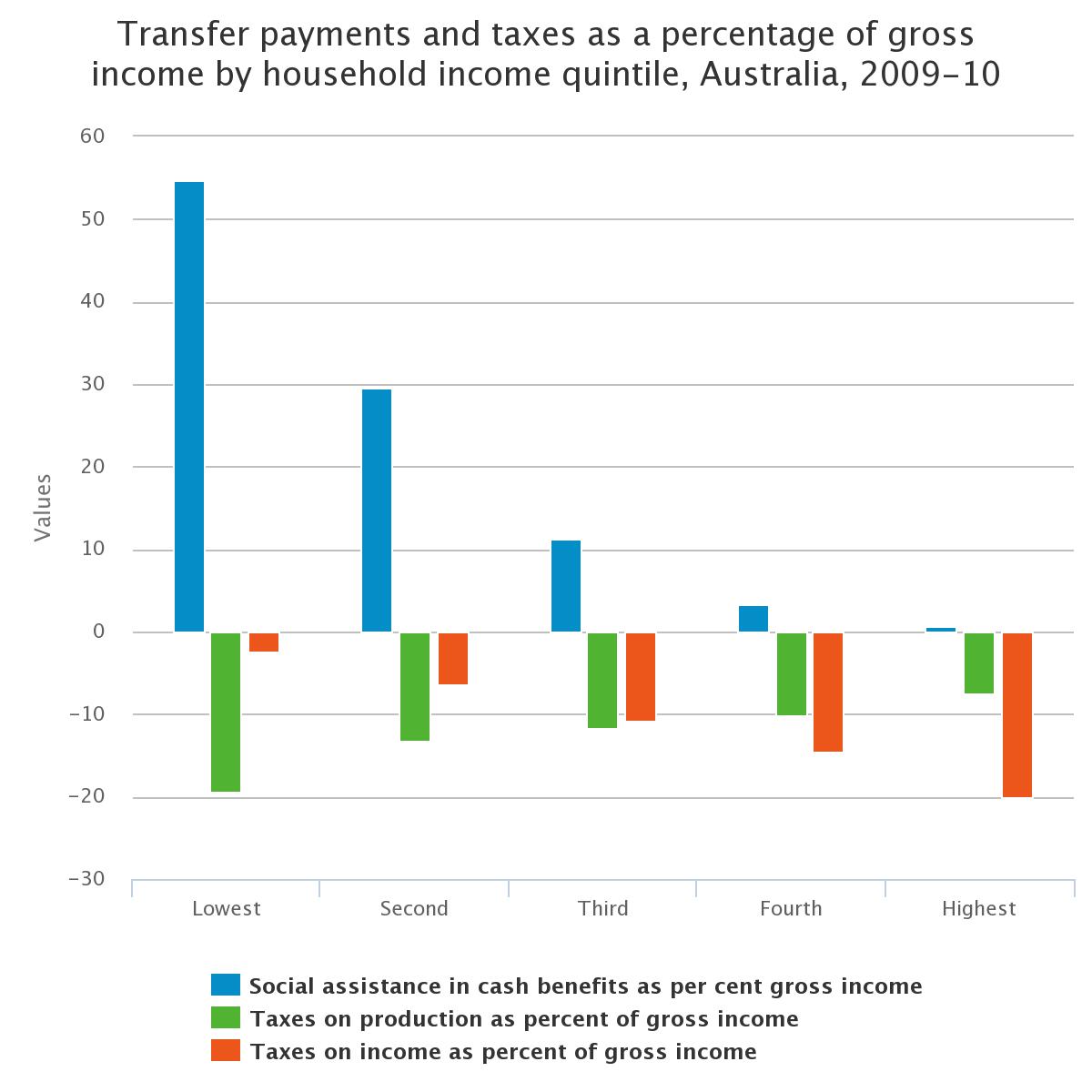

Four Myths About Income Tax Inside Story

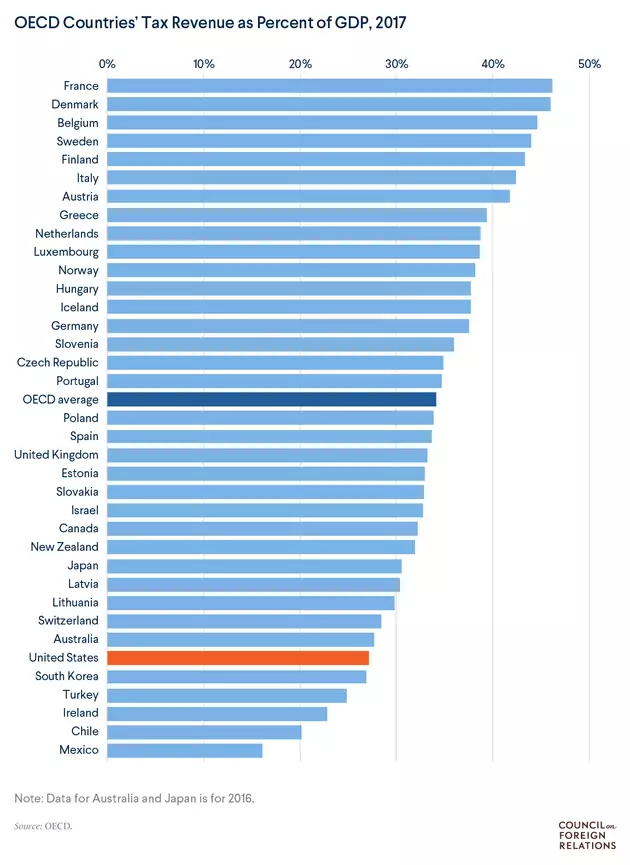

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Tax Penalties For High Income Earners Financial Samurai

How Donating To Charity Affects Your Tax Bill Zdnet

Bracket Creep Will Increase Average Tax Rates Most For Middle Income Download Scientific Diagram

Goods And Services Tax Australia Wikipedia

Colombia Tax Reform To Target High Earners Says Incoming Agency Head Reuters

No Taxation Without Emigration Briggs

Colombia Tax Reform To Target High Earners Says Incoming Agency Head Reuters